Portfolio Building Blocks

There Are No Perfect Investments, But There Are Near-Perfect Portfolios.

The investment landscape has evolved and is becoming more complex. Diligent investment principles are key to building a firm foundation for your portfolio. Our structured investment approach guides the management of all investment strategies offered by our firm. It includes five key principles:

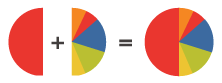

Our Quadrant Plan approach seeks to integrate the benefits of both custom portfolios and model portfolios. We offer a variety of investment strategies, which we consider building blocks for your portfolio. Our investment strategies intentionally complement one another by maintaining a unique focus and targeted investment exposure. The Quadrant Plan framework allows us to uniquely tailor a mix of portfolios to your specific situation.

The Whole is Greater than the Sum of its Parts.

Benefits of the Quadrant Plan

Many investors believe that diversification across securities and financial markets adds value to their portfolio. We believe this concept should be taken a step further by diversifying your portfolio across different types of investment management approaches, or objectives. The Quadrant Plan allocates your portfolio’s underlying accounts into various quadrants, which provides you with much more control and flexibility in several key areas:

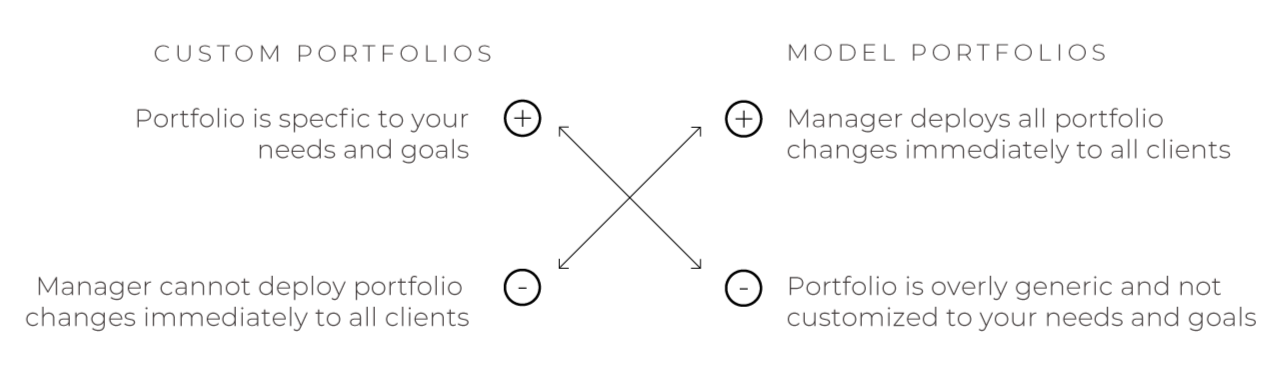

Portfolios with Purpose

The Quadrant Plan helps you identify your investment needs and, as a result, ensure your portfolio has an appropriate emphasis across four purposes.

Liquid

Purpose

Income Yield, Accessibility

Investments

Money Markets, Bonds, Cash

Protected

Purpose

Preservation, Stability

Investments

CDs, Annuities, Structured Products

Balanced

Purpose

Foundational Diversification, Total Return, Growth & Income

Investments

Broad Market Exposure Including Stocks, Bonds, Alternative Assets

Growth

Purpose

Capital Appreciation, Outpace Inflation

Investments

Stocks, Uncorrelated Assets, Growth-Oriented Investment Strategies